12 March 2016

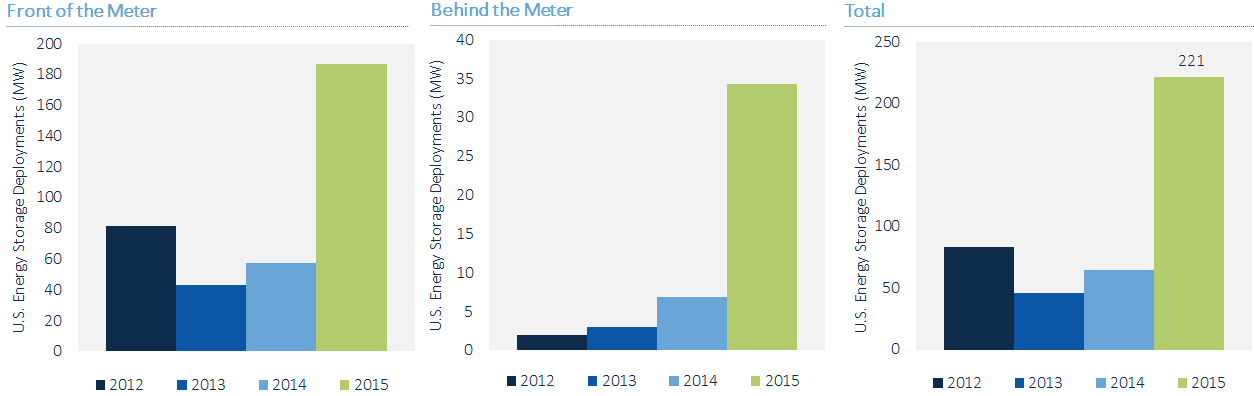

The U.S. energy storage market just had both its best quarter and best year of all time. According to the GTM Research/Energy Storage Association’s U.S. Energy Storage Monitor 2015 Year in Review, the U.S. deployed 112 megawatts of energy storage capacity in the fourth quarter of 2015, bringing the annual total to 221 megawatts. This represents 161 megawatt-hours for the year.

The 112 megawatts deployed in the fourth quarter 2015 represented more than the total of all storage deployments in 2013 and 2014 combined. Propelled by that historic quarter, the U.S. energy storage market grew 243 percent over 2014’s 65 megawatts (86 megawatt-hours).

FIGURE: Annual U.S. Energy Storage Deployments, 2012-2015

Source: GTM Research/ESA U.S. Energy Storage Monitor

The report breaks down the market into three segments: residential, non-residential and utility. The utility segment, also called front-of-meter, continues to be the bedrock of the U.S. energy storage market. In 2015, front-of-meter storage accounted for 85 percent of all deployments for the year. Most of these deployments were in the PJM market, where over 160 megawatts of energy storage systems went on-line in 2015.

The residential and non-residential segments combine to make up the behind-the-meter market. While much smaller, the behind-the-meter market grew 405 percent in 2015. The report notes that the residential market is geographically diverse but was led by Hawaii for the year. California led the non-residential segment.

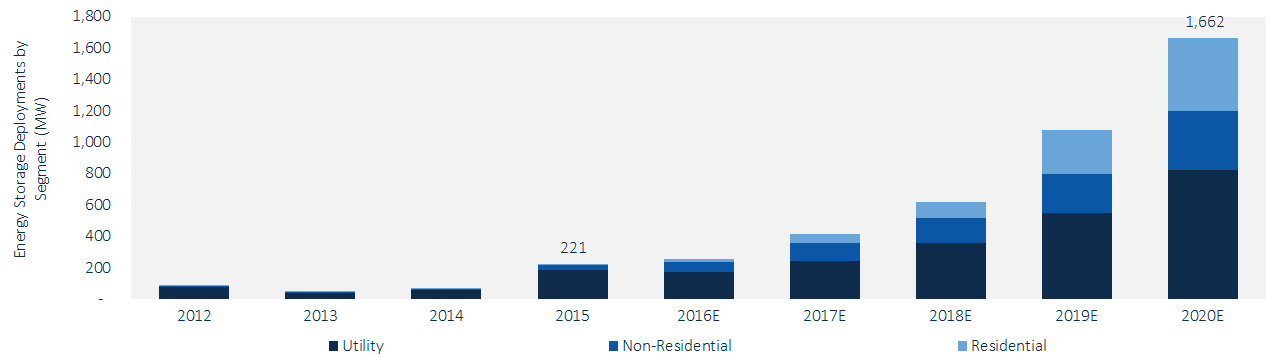

GTM research forecasts that the annual U.S. energy storage market will cross the 1-gigawatt mark in 2019, and by 2020 it will be a 1.7-gigawatt market valued at $2.5 billion.

“We can look back at 2015 as the year when energy storage really took off,” said Ravi Manghani, GTM Research senior energy storage analyst and author of the report. “While most of the growth was limited to a single wholesale market of PJM, we expect growing interest for storage in several markets.”

“Energy storage is changing the paradigm on how we generate, distribute and use energy. With exponential growth predicted over the next couple of years, energy storage solutions will deliver smarter, more dynamic energy services, address peak demand challenges and enable the expanded use of renewable generation like wind and solar,” said Matt Roberts, executive director of the Energy Storage Association (ESA), adding, “The net result will be a more resilient and flexible grid infrastructure that benefits American businesses and consumers.”

Today, more utilities are considering storage along with an assortment of traditional and non-traditional assets to meet reliability, capacity and system upgrade needs. The recent extension of several federal renewable tax credits is expected to further boost energy storage as more storage paired with renewables will be deployed.

FIGURE: Annual U.S. Energy Storage Deployments, 2012-2020

Source: GTM Research/ESA U.S. Energy Storage Monitor

Key Findings

- The U.S. deployed 111.8 megawatts of energy storage in Q4 2015, which was higher than deployments in 2013 and 2014 combined.

- The U.S. deployed 221 megawatts of storage in 2015, up 243 percent over 2014.

- Installed system prices for utility projects for energy applications to be completed in 2017 will be lower by 29 percent versus 2015, and for power applications, the prices will be lower by 25 percent.

- GTM Research forecasts that the annual U.S. energy storage market will cross the 1-gigawatt mark in 2019 and by 2020 will be a 1.7 gigawatt market valued at $2.5 billion.

- In 2015, front-of-meter storage accounted for 85 percent of all deployments for the year.

- 20 state markets had energy storage policy activity in 2015, up from 10 states in 2014.